Momentum traders assert that “the trend is your friend.” When the price of an asset increases, it is a good time to enter the market or make a purchase. Additionally, you should purchase (go long) because the asset is gaining momentum. Generally, if an asset’s price evolution has been positive, the likelihood is that it will continue to rise. Is this, however, true in real-world trading? How much confidence can you place in momentum trading or, for that matter, the trend?

In this momentum trading guide, we’ll discuss some tried and true strategies for profiting from the practice of trend following. For instance, if a stock reaches a new high following the release of record earnings by its issuing company, a momentum trader may purchase shares in the stock and attempt to drive the price higher. Alternatively, momentum traders may participate in a so-called short squeeze (the artificially induced action of purchasing a stock/asset in order to drive the price higher, as was the case with AMC or GameStop), in the hope that the price will continue to rise.

In layman’s terms, momentum trading

In physics, the term “momentum” refers to the amount of motion used by a moving body. For instance, when a car accelerates, it is perfectly acceptable to refer to it as “gaining momentum.” To be sure, the concept is not foreign to trading.

Momentum trading is an investment strategy that seeks to profit from the direction of an asset’s price movement. Trends can be influenced by a variety of factors, including earnings reports, analyst or expert opinions, market sentiment, and economic drivers, or they can be purely technical in nature. Technical analysis, on the other hand, relies on patterns and indicators to identify and analyze trends.

You can use momentum to either go long (purchase) or short (sell) (sell). All of the recent meme stock rallies in the last couple of years are examples of short-term momentum trading, as is earnings release trading. However, there are momentum stocks, such as Tesla, that are on a consistent long-term uptrend. Tesla has arguably been a momentum stock for the better part of a decade. Long-term momentum investing is also referred to as “position trading,” whereas intermediate-term momentum investing is referred to as “swing trading.” In terms of duration and the various types of trading based on the duration of a position, you should also be aware that day trading, as opposed to swing and position trading, is a short-term form of momentum trading.

Investing for the long term vs. trading for the short term

As previously stated, the objective of long-term investing based on fundamental facts is to “buy low and sell high.” On the other hand, momentum trading’s objective is to “buy high and sell high.”

You should be familiar with momentum trading strategies.

A general rule in momentum investing is that a stock that reaches a record high is likely to surpass it. To identify momentum stocks, for example, you could use a stock screener to identify stocks that trade within 5% – 10% of their 52-week highs.

Typically, traders identify momentum stocks based on their own criteria (i.e., small companies, volatility, volume, time frame). Numerous traders identify them through the use of chart patterns and indicators. Continue reading to learn more about these criteria and how they can be used in conjunction with momentum investing.

Volatility

Volatility is out of control. Volatility, defined as the degree to which the price of an asset changes over time, is a measure of a market’s stability. A market with a high level of volatility is characterized by large price swings, whereas a market with a low level of volatility is more stable (and less exciting for momentum traders).

Typically, momentum traders are attracted to markets that are moderately to extremely volatile, looking to profit from short-term price peaks and declines. Due to the fact that volatility is a primary driver of momentum trading, it is critical to have an effective risk management strategy in place to safeguard your capital against contrarian market movements. Stop and limit orders are also useful for mitigating risk.

Volume

The volume of an asset indicates how much of it is traded during a specified time period or time frame. It is critical to understand that volume does not refer to the number of transactions involving the asset conducted via the trading platform, but to the total number of assets traded. For instance, if five investors each purchase one Tesla share, the transaction is treated as if one investor purchased five Tesla shares.

Volume is critical for momentum investors, as they seek to enter and exit trades quickly, which requires a stable supply and demand balance. The more buyers and sellers there are, the more liquid the market. The fewer buyers and sellers in a market, the less liquid it is considered.

Time period

As previously stated, momentum trading is dependent on short-term price movements. However, the duration of a position is contingent upon the strength of the trend. From this vantage point, momentum trading is a flexible trading strategy that is suitable for both long and short-term traders, such as scalpers.

Indicators that are utilized in momentum trading

Due to the fact that fundamental analysis takes a back seat in momentum trading, traders are primarily concerned with price action and technical indicators. The Intraday Momentum Indicator (IMI), the Relative Strength Index (RSI), Moving Averages (MAs), and the Stochastic Oscillator are all indicators that are frequently used in this type of trading.

Momentum Indicator for Intraday Trading (IMI)

The IMI is the preferred indicator of momentum investors because it considers the most recent closing price and compares it to the previous closing price. As a result, it is ideal for traders attempting to ascertain the strength of a trend.

It is classified as an oscillator and is represented by a single line that moves from and to the zero centerline (or 100 sometimes). This indicator’s value informs traders about the frequency with which a price changes. If the IMI, for example, is 45, it indicates that the uptrend is stronger in comparison to a previous reading of 39. In comparison, a reading of -17 indicates a stronger downtrend than a reading of -15.

The Index of Relative Strength (RSI)

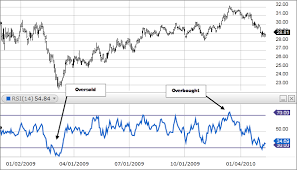

The RSI indicator is frequently used to generate buy and sell signals. As with the IMI, the RSI is displayed on a separate chart beneath the price chart and is represented by a line ranging from zero to one hundred.

Additionally, it functions as an oscillator, assisting traders in identifying overbought or oversold market conditions. In general, a reading of 30 or less on the RSI indicates an oversold or undervalued market condition. A reading of 70 or greater, on the other hand, indicates an overbought or overvalued market condition.

When used in conjunction with the momentum strategy, the RSI enables traders to identify retracements between these price levels (30 and 70) and establish clear trends. Momentum traders typically enter and exit positions at the trend’s midpoint, rather than at the trend’s top or bottom.

It is critical to remember that just because the RSI indicates an asset is overbought or oversold does not mean the trend will reverse anytime soon. This is why it is critical to combine the RSI with other indicators, such as Moving Averages or the Stochastic Oscillator, in order to achieve greater precision.

Averages that fluctuate (MAs)

Moving averages are used by traders to identify new trends. In general, momentum traders use MAs to determine whether a market is rangebound or not, as MAs filter out minor price fluctuations to reveal the prevailing price trend.

15-day, 25-day, 35-day, 50-day, and 100-day MAs are frequently used. If the shorter-term MA is plotted above the longer-term MA, this indicates that the trend is gaining momentum.

Most importantly, keep in mind that moving averages are a lagging indicator, which means that any signals will materialize after the price moves. It is recommended to use MAs in conjunction with other indicators for increased precision.

When the MAs cross, a trend reversal is imminent (as soon as the price declines).

The Oscillator Stochastic

The Stochastic Oscillator is used to compare the most recent closing price to the previous trading range for a given time period. Interestingly, this indicator is not directionally or volume dependent. Rather than that, it is sensitive to the momentum and velocity of price changes. As a result, the stochastic oscillator is effective at forecasting price movements.

It is made up of two lines drawn on the price chart:

- The indicator line is a range-bound line that oscillates between zero and one hundred percent. A value greater than 80 typically indicates an overbought market. In comparison, a reading of less than 20 indicates an oversold condition.

- A signal line is a line drawn on a price chart. When the signal and indicator lines cross, it indicates that a significant change in direction is imminent.

Typically, if the Stochastic does not revert to the 20-point level during a pullback, the trend will resume upward.