What does ” Account Balance” means

The first step is to open an account with a retail forex broker or CFD provider.

Once your account has been approved, you can move money into it, and then you can use it.

“Risk capital” should only be used to fund this new account, which is cash you can afford to lose.

The “Account Balance” or “Balance” is the balance of your account when you open it.

It’s how much money you have in your account.

Think about this:

Balance is cash.

It shows how much money you have in your trading account.

In this case, your Balance is $1,000 after you put $1,000 into it.

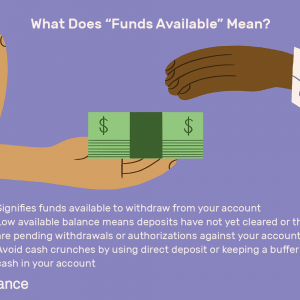

If you start a new trade, or “open a new position,” your account balance will not change until the trade is closed.

In this case, your Balance will only change in one of three ways:

- When you put more money into your account.

- When you finish a job.

- When you keep a trade open overnight and either get or pay a swap/rollover fee.

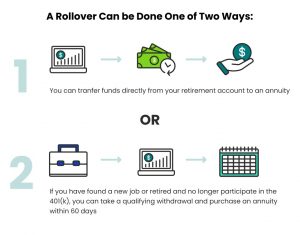

Since this is about margin, we won’t go into too much detail about swaps and rollovers, but for completeness, we will. Swap fees do affect your Balance, so we’ll quickly go over them.

The difference between an hour-long trade and one you keep open all night is clear.

In trading, a rollover is when you move open positions from one day to the next by moving them from one account to another.

Most brokers do the rollover for you. They close any open positions at the end of the day, and then open a new one for the next business day at the same time. A swap is made during this rollover.

You pay or get charged for a swap at the end of each trading day if you keep your trade open overnight.

In the event that you are paid for a swap, cash will be added to your Balance account.

In the event that you are charged swap, cash will be taken from your Balance.

Otherwise, these swap fees are usually small, but they can add up over time if you trade a lot of money.

To see the swaps on your open position in MetaTrader, you need to open a “Terminal” window and click on the “Trade” tab. If you keep your position open for more than one day, you can see them.

If you want to learn more about swap and rollover, you’ll have to look up those terms on your own. We just wanted to talk about them briefly for clarity’s sake.