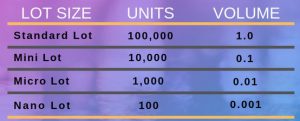

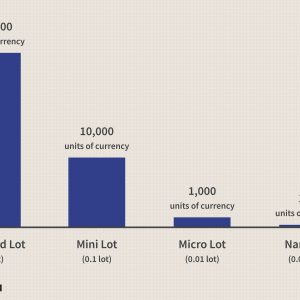

In foreign exchange a micro lot is a lot size that is one-tenth the size of a regular lot, which is 100,000 units—or 10,000 units—in size. When trading a micro lot of a currency pair based in U.S. dollars, one pip is equal to $1.00, however when trading a regular lot of the same currency pair, one pip is equal to $10.00. Mini lots are the most frequent lot sizes in forex mini accounts, which may be opened with some forex broker dealers and used to trade currency pairs.

Mini Lots: What You Need to Know

Mini lots are frequently utilized by novice traders who are new to the market and learning the ropes of the trading business. As a result of the fact that price swings in mini lots have a far smaller impact on profit and loss, the volatility of open positions is lower, and traders do not require as much capital in their accounts. New traders can start with as little as $100 in a small account, as opposed to having to fund a normal account with $1,000 or $10,000 to begin trading with.

Mini lots can also be used by advanced traders to get greater control over their trade positions. For example, a trader may desire to average into a new trend in smaller increments than 100,000 units at a time rather than 100,000 units at a time. Automated traders can also benefit from the 10,000 unit increments of mini lots, which allow them to fine-tune their tactics in order to achieve maximum profits while taking on the least amount of risk.

Mini Lots are not the only option.

The use of mini lots is widespread among new forex traders, but there are a few additional options to consider as well, including:

- Micro Lots – Micro lots are one-tenth the size of a mini lot, or 1,000 units of a base currency, and are used to trade on the stock exchange. When trading a micro lot of a currency pair based in U.S. dollars, one pip of a currency pair is equal to just $0.10 cents.

- Nano Lots – Nano lots are one-hundredth the size of a micro lot and one-tenth the size of a mini lot, or 100 units of a base currency. Micro lots are one-hundredth the size of a mini lot. When trading a Nano lot, one pip of a currency pair based in United States dollars is equal to just $0.01 cents.

When you’re just getting started, it’s tempting to utilize the smallest lot sizes possible in order to reduce the amount of capital at risk. The problem is that when significant quantities of capital are at stake, traders have a tendency to operate in a different manner. When starting started, it’s vital to gradually increase the amount of cash at risk rather than immediately switching from a Nano lot size to a normal lot size if a strategy appears to be successful. When scaling up their lot sizes after designing a successful strategy, algorithmic traders should make certain that there are no changes in slippage or other fees associated with the technique.