What is Forex Spread? You must first get a clear understanding of the overall structure of every forex trade in order to properly understand the forex spread and how it affects you. All trades are done through intermediaries who fee for their services, according to one view of the trade structure.

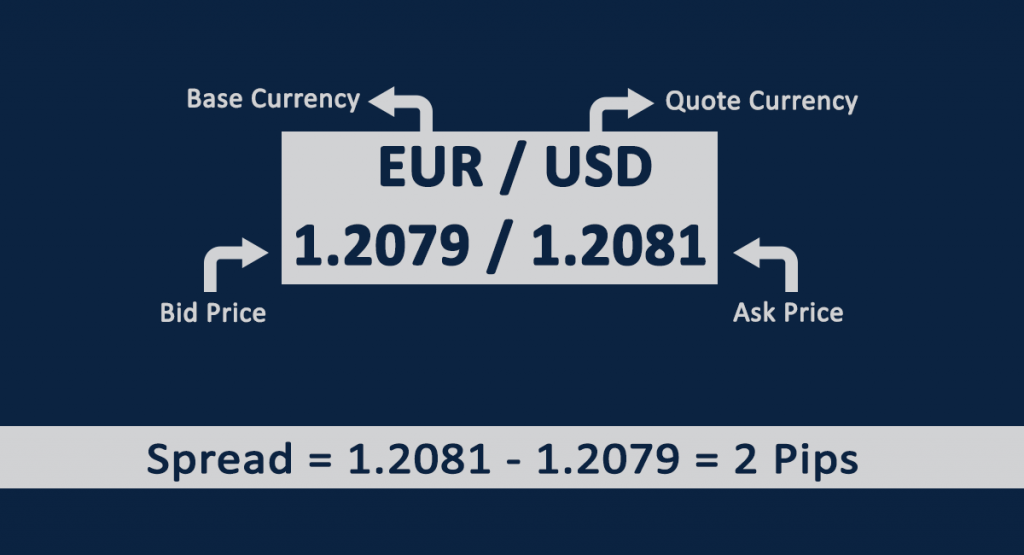

A forex spread refers to the charge which is the trade’s difference between the bidding and the asking price. This is known as spread.

The Bid-Ask Spread Fully Defined

The forex spread represents two prices: the purchasing (bid) and selling (ask) prices for a certain currency pair. Traders pay a set price for the currency and must sell it for a lower price if they wish to sell it back immediately.

Consider this easy analogy: when you buy a brand-new car, you pay the market price for it. The car depreciates the moment you drive it off the lot, so if you wanted to sell it back to the dealer immediately away, you’d have to accept less money.

In the automobile example, depreciation accounts for the difference, whereas in a forex trade, the dealer’s profit accounts for the difference.

How to Forex Market Makers Determine the Spread?

The FX market is different from the New York Stock Exchange, where trading used to take place in a physical location. The FX market has always been virtual, and it operates similarly to the over-the-counter market for smaller companies, with deals facilitated by experts known as “market makers.”

The buyer could be in London and the seller could be in Tokyo, so a middleman is required to facilitate the transaction.

The specialist, who is one of several who enables a certain currency transaction, may be in a third city. His duties include ensuring an orderly flow of purchase and sell orders for those currencies, which entails matching every buyer with a seller and vice versa.

In practice, the specialist’s task involves great risk. It’s possible, for example, that they accept a bid or purchase order at a certain price, but the currency’s value rises before they find a seller.

The specialist is still in charge of filling the approved buy order, and they may have to accept a greater sell order than the one they agreed to fill.

Take Note: The spread may not seem like much, but .0004 profit equates to four pips, or $40 profit for a standard lot of EUR/USD. The facilitator can assist in thousands of these trades per day.

The Cost of the Forex Spread

The spread of 0.0004 British Pound (GBP) in the example above may not seem like much, but even a small spread soon adds up when a deal grows larger. Forex currency trades usually involve higher sums of money.

You may only trade one 10,000-unit lot of GBP/USD as a retail trader. However, the average trade is substantially greater, involving about one million GBP/USD units. In this larger trade, the 0.0004 spread equals 400 GBP, which is a far higher commission.

How to Manage and Minimize the Spread

You can minimize the cost of these spreads in two ways:

Only trade at the most favorable trading hours, when there are a large number of buyers and sellers in the market. As the number of buyers and sellers for a particular currency pair grows, so does competition and demand for the business, and market makers often decrease their spreads to take advantage of it.

Avoid buying or selling currencies that aren’t heavily traded. When trading popular currencies like the GBP/USD pair, multiple market makers compete for your business. There may be only a few market makers willing to accept your trade if you trade a thinly traded currency pair. They will retain a broader spread as a result of the reduced competition.

What’s a Good Spread in Forex Market?

To get an idea of what a healthy spread in forex is, look at the most liquid forex pairs. Popular forex pairs include USD/JPY and USD/GBP. You might compare the spreads of those pairings to those of other pairings. It’s also a good idea to research spreads various brokerages to be sure you’re getting the greatest bargain possible.

What Does a High Spread Mean in Forex?

High spreads indicate a pairing’s liquidity is lower than that of other pairs. In other words, the pair is attracting fewer traders and dollars. The fewer traders who focus on a pair, the less probable someone will be prepared to provide a price that is closer to the other side of the deal. The spread widens when trading occurs less frequently. Even if it advertises itself as a “commission-free” trading platform, brokers may incorporate trading fees in the spread.