Are you a trader who wants to broaden your trading horizons by learning about different sorts of orders in different markets?

Thank you for taking the time to read this article.

In this article, I’ll go over the many types of orders available in the FX, stock, and cryptocurrency markets.

Permit me to remind you, though, that markets are governed by regulations.

Before trading in any of these markets, you must first comprehend the concepts of financial and technical analysis.

Let’s get this party started.

What Exactly Is An Order?

An order, according to the definition, is a written directive given to provide money or property to someone or something.

The offer to purchase or sell a currency through the use of a broker is referred to as a forex order.

When a trader orders a broker to purchase or sell a currency, this occurs.

The type of order, on the other hand, will influence when it is performed.

In crypto, it is also an instruction given by a trader to purchase or sell a coin at a specific moment.

It is the opportunity to buy or sell a commodity at a price on the stock exchange market.

Nobody can execute a deal without an order.

The Most Common Order Types

Orders change depending on the market.

However, in terms of how traders utilize them, the majority of these orders appear to be the same.

There are a lot of orders in the FX, stock, and cryptocurrency markets. In this section, I’ll explain the three most common sorts of orders in these markets.

The market order, stop-loss order, and take-profit order are the three types of orders.

The Order of the Market.

The market order is a trader’s entry order into the market. It is an order to purchase a currency or commodity as soon as a trader places one.

Finally, traders in the forex, cryptocurrency, and stock markets frequently employ this order.

The Stop-Loss Order is a type of stop-loss order that is used

Traders utilize the stop-loss as a pending order, which is an order that traders place over a specific timeframe to indicate when the order is ready to be executed.

When a trade goes against a trader’s prediction, the stop-loss order helps to mitigate excessive losses.

It is also the point at which a trade automatically ends to prevent further losses. This order is used by many traders to protect their funds.

The Take-Profit Order is a type of order that allows you to profit from your

Traders utilize this order to set aside a portion of their profits.

It’s an order that allows traders to protect their profits initially, before any loss from a reversal or retracement.

The broker automatically closes a trader’s trade once the price reaches the take profit-profit position. The broker then adds his profit to his account.

When Is It Best To Trade Forex?

Sincere Advice

Orders of a Different Nature.

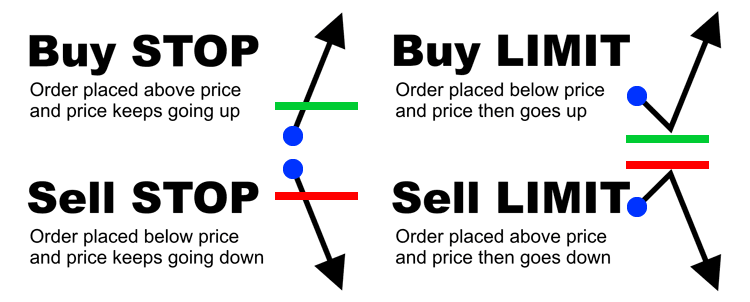

The Order to Discontinue.

A stop order is an order to purchase or sell a currency or commodity at a specific price when the market reaches it.

It refers to the point at which traders wish to begin selling or buying a currency or commodity.

The broker will not execute the trade if the market price does not reach the point that the trader selects.

In the forex, cryptocurrency, and stock markets, this form of order is employed.

The Order of Limitation.

Limit orders are used by traders to sell and purchase currencies whenever the market price reaches a certain level.

It’s also a type of pending order in which the deal isn’t executed until the price hits a certain level established by the trader.

A trader’s price for a purchase limit is typically lower than the market price.

On the other hand, a sell limit price is frequently higher than the market price.

The Stop-limit Order is a type of order that allows you to set a limit

This is a hybrid order that combines the stop and limit orders.

The stop-limit is an instruction to construct a limit order to purchase or sell when a specified price is met.

The good till cancel order, trailing stop order, good for the day order, and so on are examples of other sorts of orders.

Orders Are Very Important In Trading And Exchange.

The most important aspect of an order is that it comes before a trade execution. A broker will not execute a trade without an order.

Another important function of orders is to protect trade capital. Stop-loss and take-profit orders are useful in this situation.

Furthermore, orders aid in profit maximization. Stop and limit orders aid in the execution of trades when market conditions are favorable.

Most Commonly Asked Questions (FAQs)

What is a trading order?

An order is a request for a trade to be executed by a broker.

What are the different kinds of orders?

Market orders, stop-loss orders, take-profit orders, stop orders, limit orders, and so on are examples of many types of orders.

SYNOPSIS – ORDER TYPES

An order is a request for a trade to be executed from a trader to a broker. It’s a request to enter or leave a market.

Traders execute orders in the crypto, forex, and stock markets to maximize their earnings.

The market order, stop-loss order, and take-profit order are the three major orders.

Stop orders, limit orders, stop-limit orders, and so on are examples of other sorts of orders.