The Stochastic Oscillator is a momentum indicator that displays where the closing price is in relation to the high-low range over a period of time.

It was created in the late 1950s by George C. Lane. He felt that price changes before momentum, thus he devised the Stochastic Oscillator to track price’s “speed” or momentum.

This oscillator is based on the notion that prices will remain equal to or above the previous period’s closing price during an uptrend, and prices will remain equal to or below the previous period’s closing price during a downturn.

In a nutshell, this is how it goes:

- The closing price in an upswing tends to be near the high.

- The closing price in a decline tends to be around the low.

- Momentum is deemed to be slowing when the closing price begins to drift away from the high or low.

- In large trading ranges or slow-moving trends, stochastics work best.

Stochastic Processes in Action

From 0 to 100, the indicator can be used.

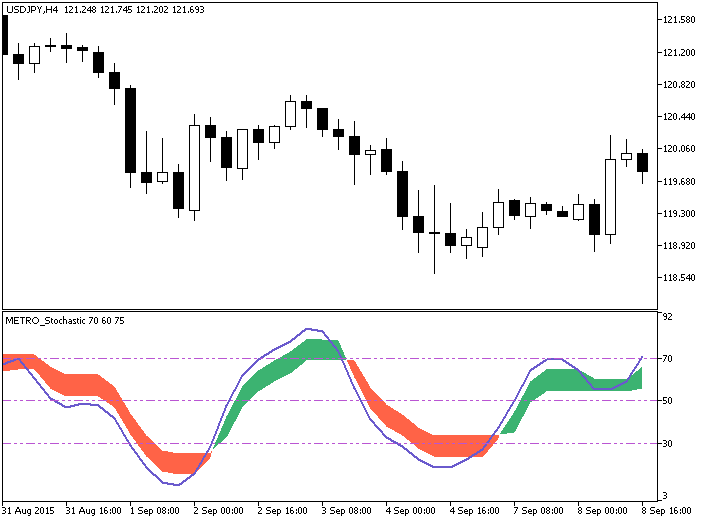

The rapidly oscillating percent K and a moving average of percent K, generally referred to as percent D, are graphed.

The Stochastic Oscillator is a time-based indicator that gauges how near the close is to the high-low range.

Assume that the high point is 100, the low point is 90, and the close point is 98.

The denominator in the percent K formula is 10, which indicates the high-low range is 10 (100-90).

The numerator is equal to the sum of the close and the lowest low.

dividing 8 by 10 equals. 80 or 80%

To determine percent K, multiply this amount by 100.

If the closing was at 92, percent K would equal 20. (.20 x 100).

When the close is in the higher half of the range, the Stochastic Oscillator is above 50, and when it is in the lower half, it is below 50.

Low values (below 20) suggest that the price is close to its all-time low.

High values (over 80) imply that the price is close to its all-time high.

How to Trade Overbought/Oversold Stochastic Conditions

The most often utilized values are 80 and 20. In general, a zone above 80 is regarded overbought, whereas a range below 20 is considered oversold.

- When the oscillator crosses above 80 and then below 80, it is a sell signal.

- When the oscillator falls below 20 and then crosses back above 20, it is a buy signal.

Crossover Indicator

When the two lines cross in the overbought or oversold range, a crossover signal is generated.

- In the overbought zone, a declining percent K line passes below the percent D line, signaling a sell signal.

- In the oversold zone, an expanding percent K line crosses over the percent D line, signaling a buy signal.

Divergences

When the price establishes a new high or low, but the Stochastic Oscillator does not, a divergence occurs.

- When the price makes a lower low but the Stochastic Oscillator produces a higher low, this is called a bullish divergence. This shows that there is less negative momentum, indicating a possible positive turnaround.

- When the price makes a higher high but the Stochastic Oscillator makes a lower high, this is known as a bearish divergence. This implies a possible negative reversal as there is less upward momentum.

The Stochastic Oscillator is available in three different versions: Fast, Slow, and Full.

The value of the basic Stochastic Oscillator is calculated differently in each iteration.