How do Margin and Leverage relate to each other? Understand the Relationship Between Margin and Leverage

Margin is used to build leverage.

When using a margin account, leverage refers to the extra “trading power” available.

You can use leverage to trade positions that are larger than the amount of money in your account.

Leverage is measured in terms of a ratio.

The relationship between the amount of money you have and the amount of money you can trade is known as leverage.

It’s commonly written in the “X:1” format.

To trade 1 standard lot of USD/JPY without margin, for example, you would need $100,000 in your account.

However, with a 1% Margin Requirement, you would simply need to deposit $1,000 in your account.

This trade would be set up with a 100:1 leverage.

Here are some Leverage Ratio examples based on the Margin Requirement:

| Currency Pair | Margin Requirement | Leverage Ratio |

| EUR/USD | 2% | 50:1 |

| GBP/USD | 5% | 20:1 |

| USD/JPY | 4% | 25:1 |

| EUR/AUD | 3% | 33:1 |

Here’s how to calculate Leverage:

Leverage = 1 / Margin Requirement

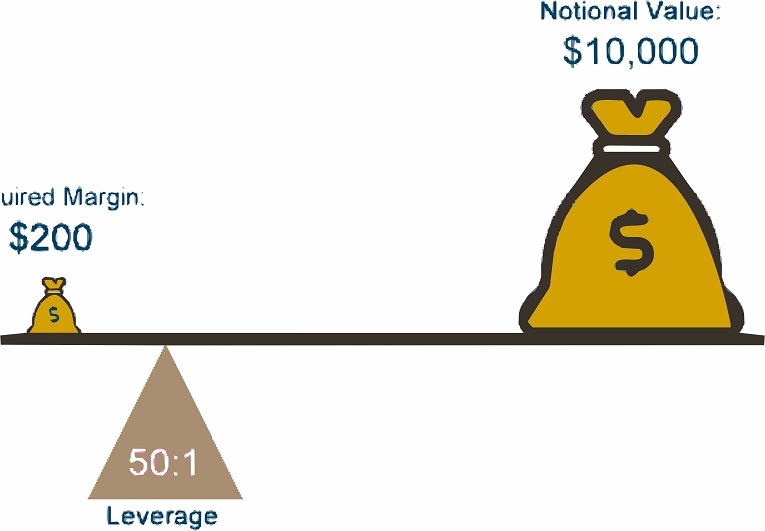

For example, if the Margin Requirement is 2%, here’s how to calculate leverage:

50 = 1 / .02

The leverage is 50, which is expressed as a ratio, 50:1

Here’s how to calculate the Margin Requirement based on the Leverage Ratio:

Margin Requirement = 1 / Leverage Ratio

For example, if the Leverage Ratio is 100:1, here’s how to calculate the Margin Requirement.

0.01 = 1 / 100

The Margin Requirement is 0.01 or 1%.

As you can see, leverage has an inverse relationship to margin.

“Leverage” and “margin” refer to the same concept, just from a slightly different angle.

When a trader opens a position, they must “in good faith” put up a portion of the position’s value. The trader is said to be “leveraged” in this instance.

The “fraction” part which is expressed in percentage terms is known as the “Margin Requirement”. For example, 2%.

The actual amount that is required to be put up is known as the “Required Margin”.

For example, 2% of a $100,000 position size would be $2,000.

The $2,000 is the Required Margin to open this specific position.

Since you are able to trade a $100,000 position size with just $2,000, your leverage ratio is 50:1.

Leverage = 1 /Margin Requirement 50 = 1 / 0.02

Forex Margin vs. Securities Margin

The terms forex margin and securities margin are not similar. It’s critical to understand the differences.

Margin is the money you borrow as a partial down payment, usually up to 50% of the purchase price, to buy and own a stock, bond, or ETF in the securities market.

“Buying on margin” is a term used to describe this strategy.

When you trade stocks on margin, you borrow money from your stockbroker to buy stock. In a nutshell, it’s a loan from the brokerage firm.

When you create a position in the forex market, margin is the amount of money you must deposit and keep on hand with your trading platform.

You do not own the underlying currency pair, and it is not a down payment.

Margin can be thought of as a good faith deposit or collateral used to ensure that both parties (buyer and seller) can fulfill their contractual obligations.

Margin in forex trading is not borrowed money like it is in stock trading.

Because nothing is really bought or sold when trading forex, simply the agreement (or contract) to buy or sell is transferred, no borrowing is required.

Margin is a phrase that is used in a variety of financial markets. There is, however, a distinction between how margin is used when trading equities and how it is used while trading forex. Prior to trading forex, it is critical to comprehend this distinction.