What Are Managed Forex Accounts and How Do They Work?

When it comes to currency trading, managed forex accounts are one form of account in which a professional money manager makes trades and transactions on the client’s behalf in exchange for a fee.

The use of a managed FX account may be an option for individual investors who are not familiar with foreign currencies but yet want exposure to this asset class. Managed forex accounts are also frequently used as sub-advised funds by money managers who want to include a currency component in their portfolio but do not have a background in foreign exchange (FX) trading or trading in general.

IMPORTANT TAKEAWAYS

A managed forex account is one in which money is placed in a forex account and the funds are then traded by a professional in the highly leveraged foreign exchange markets, according to the definition.

Managed forex accounts provide exposure to an asset class that is distinct from equities and bonds, for example.

Managed forex accounts are high-risk, high-reward investments with a high potential for profit.

Managed forex accounts can be used by both ordinary investors and professional managers who are not experts in foreign exchange trading.

Forex account managers demand substantial fees, typically ranging between 20 percent and 30 percent of a trade’s profits.

Managed Forex Accounts: What You Need to Know

The use of managed forex accounts is an excellent investment option for people who desire the possibility for high returns from leveraged forex trading, are willing to face significant risks, and want specialists to handle the selection and trading of their investments. Placing money in a forex account and having a professional trade those funds in the highly leveraged foreign exchange markets is what it is all about. Investors that choose this type of account do so with the expectation and hope of making extraordinarily high gains, but they do so with the awareness that they could also suffer serious losses.

Managed forex accounts provide exposure to an asset class that is distinct from equities and bonds, for example. The value of forex transactions increases as the value of one currency rises or falls in relation to the value of another. This is in contrast to the value of traditional securities, which provide returns in the form of share growth, interest payments, or dividends. Cryptic investments are made by people who want to hedge their risks in international markets, or they are made by people who want to profit from major movements in pricing and value between different worldwide markets.

Individual investors and speculators typically open forex accounts and attempt to trade based on their own knowledge and understanding of the financial markets. Many amateurs find this to be infamously difficult, yet those who do succeed can earn exceptionally large returns—in some cases, profits that are significantly higher than those earned by investing in equities. It is possible to avoid the additional time, effort, and, ultimately, loss that unskilled traders incur in this market by employing the services of a professional manager. A more experienced professional can be relied upon to offer profitable results, which is the hope.

Information: Managed forex accounts are similar in purpose to managed futures accounts, which are a type of alternative investment vehicle that focuses on futures contracts, stock options, and interest rate swaps, among other things. They are permitted to employ leverage in their transactions, and they are also permitted to hold both long and short positions in the securities in which they engage in trading.

Managed forex accounts are both safe and inexpensive.

Foreign exchange markets are frequently employed by experienced traders who take advantage of the ability to deal with big sums of borrowed money in order to increase their profits by leveraging their position. They have significantly more liquidity and trade at a significantly faster rate than the stock and bond markets; in fact, the FX market is the most active market in the world by volume. Furthermore, the fact that transaction costs are cheaper on it makes it a popular venue for people who enjoy the excitement of speculative investing.

Forex markets can be dangerous for inexperienced traders because they lack a sophisticated understanding of the effects of high leverage on their returns, as well as a good perception of how different news events, such as economic releases or central bank monetary policy decisions, affect the value of their currency investments.

Through the use of a managed account, ordinary investors can benefit from the experience and proven track record of an experienced and successful forex trader. The disadvantage of this technique is that the best managers often charge high-performance fees ranging between 20 percent and 30 percent of a trade’s returns, or the account profits, in exchange for their services.

Several points to note: In contrast, money managers of individual stock or bond portfolios typically charge yearly fees ranging from 0.50 percent to 5% of the assets under management. Typically, hedge fund managers charge a “two and twenty” fee, which includes a 2 percent yearly management fee on assets plus an incentive fee of 20 percent on earnings.

Special Considerations should be taken into account.

When determining whether or not to open a managed FX account, an investor should analyze the historical risk/reward profile of the potential account manager. Taking their Calmar Ratio, for example, which compares the average annual compound rate of return of their trading fund to the maximum drawdown (the portfolio’s largest shift from a high point to a low point) over the time, would be a good place to start. Typically, this ratio is measured during a three-year period of time. The greater the Calmar Ratio, the better the risk-adjusted return that the manager will generate. In contrast, the lower the risk-adjusted return ratio, the worse the performance of the company.

What Is the Process of Account Management in Forex?

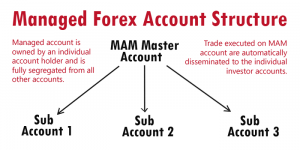

When you open a managed forex trading account, an account manager (or a team of traders) will trade your capital alongside the capital of other investors, buying and selling currencies. If you have any questions, please contact us. They have discretionary authority over the funds, which means that they make all of the decisions without consulting you before making any trades. They will typically charge a performance fee, which means that they will only be compensated if they generate revenue for you.

What is the best way to fund my forex account?

If investors just connect into their respective FX accounts and enter their credit card information, the monies will be credited to their accounts within one business day, on average. Aside from sending funds into their trading accounts from an existing bank account, investors can also use a wire transfer or an online check to deposit funds into their accounts. Alternatively, clients can send a personal check or a bank check straight to their forex brokers, however this will take longer.

What Is the Most Appropriate Account Type for Forex Trading?

The regular trading account is the most prevalent type of trading account. This account provides the user with access to normal lots of cash, each worth $100,000, that are available for purchase. To trade, you do not need to put down a minimum of $100,000 in funds.) Because of the regulations of margin and leverage, just $1,000 must be in the margin account in order for one regular lot of trading to be completed.

Mini accounts, on the other hand, are advised for beginners, risk-averse traders, and those with limited financial resources. There is a $10,000 maximum lot size reduction as a result of this. Most mini accounts can be started with as little as $250 to $500, and they offer leverage of up to 400:1 on their investments.