This week, I expect a slew of major market movers, including the U.S. advanced GDP and the BOJ decision.

ICYMI, I’ve written a quick summary of the market themes that moved currency pairs last week. Examine it out!

Here are the top economic events coming up, as well as what to expect.

Important Economic Developments:

Quarterly CPI for Australia (Apr. 27, 1:30 a.m. GMT) – The Land Down Under will publish its quarterly inflation figures for Q1 2022, most likely revealing a rise in price pressures toward the end of the period.

Remember that the conflict between Russia and Ukraine drove up global fuel and commodity prices beginning in late February. As a result, Australia’s headline CPI reading likely increased from 1.3 percent to 1.7 percent last quarter, while the trimmed mean CPI likely increased from 1.0 percent to 1.2 percent.

Higher-than-expected readings may boost RBA tightening expectations, as analysts are already pricing in a June hike.

Monetary policy decision by the Bank of Japan (Apr. 28) – Following weeks of verbal and physical intervention, the Japanese central bank is set to announce its rate decision.

Remember that officials have been paying close attention to the yen’s movements in the forex market recently, reiterating that a weak currency would benefit the Japanese economy.

More jawboning from the central bank is expected this week, as well as possible adjustments that could push the yen lower against its peers.

GDP advanced in the United States (Apr. 28, 12:30 p.m. GMT) – Following an impressive 6.9 percent growth rate in the previous quarter, Uncle Sam’s expansion is expected to slow to a meagre 1.0 percent rate in Q1.

In addition, the advanced GDP price index is set to be released, and it is expected to rise from 7.1 percent to 7.3 percent.

Stronger-than-expected results could fuel Fed tightening expectations, leading to increased calls for a 0.50 percent hike at the Fed’s next meeting.

Core PCE price index in the United States (Apr. 29, 12:30 p.m. GMT) – The Fed’s preferred measure of inflation is rounding out the U.S. data dump for the majority of the week.

Analysts predict that the March figure will fall from 0.4 percent to 0.3 percent, but this may not be enough to deter Fed rate hike bets.

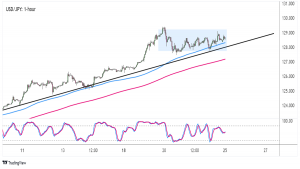

Forex Setup of the Week: USD/JPY

I’m keeping a close eye on the USD/JPY short-term consolidation pattern, especially with the BOJ decision coming up!

The central bank’s intervention has been the name of the game lately, with officials jawboning the currency for quite some time. Any actual moves during their rate statement could result in yen losses and a sharp rally for this pair.

However, technical indicators are mixed. While the 100 SMA is above the 200 SMA, indicating that the uptrend is more likely to continue than reverse, Stochastic is pointing down, indicating that selling pressure is present.

Price may continue to test support near the rising trend line visible on its short-term time frame until sellers tyre, but a break below the 128.50 area may indicate that a reversal is imminent.

Other catalysts to watch for include the release of the United States’ first-quarter advanced GDP figure and the core PCE price index for March. Slower U.S. growth data is expected, which could limit dollar gains in the short term.