The financial landscape can be incredibly dynamic and ever-changing, and it is important to understand this. Those that take the time to learn the fundamental principles of investing as well as the various asset classes, on the other hand, stand to gain handsomely over the long term.

The first step is to become familiar with the differences between different types of investments and the rungs that each one occupies on the risk ladder.

IMPORTANT TAKEAWAYS

- Investing can be a frightening proposition for first-time investors, especially given the vast number of different assets that can be included in a portfolio.

- Asset classes are classified according to their relative riskiness, with cash ranked highest in terms of stability and alternative investments ranking lowest in terms of volatility.

- For inexperienced investors, sticking with index funds or exchange-traded funds (ETFs) that closely track the market is frequently the wisest course of action.

The Investment Risk Ladder: What You Need to Know

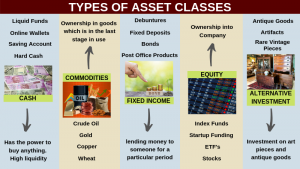

On the investment risk ladder, the major asset classes are listed in descending order of risk, starting with the least risky.

Cash

A cash bank deposit is the most straightforward and most comprehendible financial product available—as well as the safest. It not only provides investors with accurate knowledge of the interest that they will earn, but it also provides an assurance that their capital will be returned.

On the negative, the interest generated on cash that is stashed away in a savings account is rarely higher than the rate of inflation. Despite the fact that certificates of deposit (CDs) are less liquid than savings accounts, they normally offer higher interest rates than those offered by savings accounts. However, the money placed in a CD is locked up for a length of time (ranging from months to years), and there may be fines if the money is withdrawn before the time period has expired.

Bonds

A bond is a debt instrument that represents a loan made by an investor to a borrower, represented by the term “bond.” Bonds are typically issued by corporations or government agencies in which the borrower agrees to pay a fixed interest rate to the lender in exchange for the use of their capital. When it comes to corporations, bonds are frequent. They can be used to finance operations, purchases, and other tasks.

Bond rates are largely controlled by the rate of interest on the bond. In order to take advantage of this, they are extensively traded during periods of quantitative easing or when the Federal Reserve—or other central banks—raise rates.

Mutual Funds are a type of investment fund that invests in other people’s money.

A mutual fund is a sort of investment in which a group of investors pool their money together in order to purchase securities on their behalf. Mutual funds are not always passive investments, as they are managed by portfolio managers who allocate and distribute the pooled investment across stocks, bonds, and other assets, as well as other investments. Those interested in diversifying their investments can purchase mutual funds for as little as $1,000 per share, allowing them to choose from among up to 100 different equities housed inside a specific portfolio.

Mutual funds, such as the S&P 500 and the Dow Jones Industrial Average, are sometimes created to replicate the performance of underlying indexes. Actively managed mutual funds are also available, which means that they are updated on a regular basis by portfolio managers who closely track and alter their allocations within the mutual fund. These funds, on the other hand, typically have higher costs, such as annual management fees and front-end charges, which can reduce an investor’s profits.

In order to ensure that mutual funds are valued at the conclusion of each trading day, all buy and sell transactions are completed after the market closes.

Exchange-Traded Funds (ETFs) are mutual funds that are traded on an exchange (ETFs)

Since their inception in the mid-1990s, exchange-traded funds (ETFs) have grown in popularity and are now widely available. Exchange-traded funds (ETFs) are identical to mutual funds, except that they trade on a stock exchange throughout the day. These instruments mimic the buying and selling activity of equities in this way. This also implies that their value can fluctuate dramatically throughout the course of a trading day.

ETFs can track an underlying index, such as the S&P 500, or any other basket of equities that the ETF issuer wishes to associate with a specific ETF, such as the NASDAQ 100. This can comprise everything from emerging markets to commodities, as well as specific economic sectors such as biotechnology or agriculture, among other things. ETFs are immensely popular among investors due to the ease with which they can be traded and the extensive coverage they provide.

Stocks

Shares of stock allow investors to participate in a company’s success by increasing the value of their shares and receiving dividends. When a corporation is liquidated (that is, when it becomes bankrupt), shareholders have a claim on its assets, but they do not actually possess those assets.

The ability to vote at shareholders’ meetings is granted to holders of common stock. Despite the fact that preferred stockholders do not have voting rights, they do have a preference over regular stockholders when it comes to dividend payments.

Alternative Investments are investments that are not traditional.

There is a large array of alternative investments to choose from, including the sectors listed below:

Real estate: Investors can obtain real estate by purchasing commercial or residential properties straight from the owner. Alternatively, they can invest in real estate investment trusts by purchasing shares of the trust (REITs). REITs operate in a similar manner to mutual funds, with a group of investors pooling their money together to purchase real estate. They trade on the same exchange as stocks and are subject to the same regulations.

Hedge funds: Hedge funds may invest in a variety of assets aimed to generate returns that are above and beyond market returns, referred to as “alpha.” Nonetheless, success cannot be predicted with certainty, and hedge funds can experience dramatic swings in returns, sometimes outperforming the market by a substantial margin. These vehicles, which are typically exclusively available to authorized investors, frequently necessitate large initial contributions of $1 million or more. They also have a tendency to place restrictions on net worth. Hedge fund investments have the potential to lock up an investor’s money for extended periods of time.

Private equity fund: Private equity funds are pooled investment vehicles that are similar to mutual and hedge funds in that they pool money from investors. A private equity business, often known as a “adviser,” aggregates money placed in a fund by several investors and then makes investments on the fund’s behalf, according to the definition of private equity. Private equity firms frequently acquire a controlling position in an operational company and actively manage the company in an effort to increase the value of the company. Other private equity fund tactics include focusing on fast-growing companies or startups as potential investment opportunities. Private equity businesses, like hedge funds, tend to concentrate on long-term investment possibilities with a time horizon of at least ten years.

Commodities: Commodities are tangible resources such as gold, silver, and crude oil, as well as agricultural products, that are traded on international markets.

There are a variety of methods for gaining access to commodity investments. An investment vehicle known as a commodity pool, often known as a “managed futures fund,” is a private investment entity that pools contributions from numerous investors in order to participate in the futures and commodity markets. One advantage of commodities pools is that the risk borne by an individual investor is limited to the amount of money she contributes to the fund. Specialized ETFs that are meant to focus on commodities are also available.

How to Invest Wisely, Suitably, and Straightforwardly

Many experienced investors diversify their portfolios by incorporating the asset classes indicated above, with the asset allocation reflecting the investor’s risk tolerance. A helpful piece of advise for investors is to begin with small investments and then gradually build up their portfolios. To be more specific, mutual funds or exchange-traded funds (ETFs) are an excellent starting point before moving on to individual stocks, real estate, or other alternative investments.

The majority of people, on the other hand, are far too busy to be concerned with daily portfolio management. In this case, sticking with index funds that are designed to replicate the market is a sensible option. Further, according to Steven Goldberg, a principal at the firm Tweddell Goldberg Wealth Management and a long-time mutual funds columnist for Kiplinger.com, the majority of investors need just three index funds: one that tracks the performance of the United States equity market, another that tracks the performance of international stocks, and a third that tracks the performance of a broad bond index.

What’s the bottom line?

Investment education is critical, as is avoiding assets that you aren’t completely comfortable with. Investing advice from experienced investors should be trusted, but “hot suggestions” from untrustworthy sources should be avoided. When looking for consulting professionals, search for independent financial advisors who are compensated only for their time, rather than those who are compensated on a commission basis. Lastly and most importantly, diversify your holdings across a broad range of assets.