The moving average envelope, or MAE, is a trend-confirmation tool. This indicator includes a moving average.

Traders all over the world use moving averages as a trading indicator. It “smoothest” the market’s pricing and “predicts” its direction. When the price of a currency pair falls below a moving average, it is considered a sell signal. When the price is above a moving average, however, it is a buy signal.

In range markets, however, the moving average crosses price far too frequently. This action generates a large number of misleading signals. Using the envelope indication is a smart approach to deal with this problem.

What Is The Function Of The Moving Average Envelope?

A moving average is placed between two lines in a moving average envelope indicator. The upper envelope is higher than the moving average, while the lower envelope is lower than it.

The envelope indicator is mostly used to provide further confirmation to moving averages. For trading decisions, the price of the moving average crossing is insufficient.

As a result, the price has closed above or below the upper or lower bands for more confirmation.

Overbought and oversold levels indicate the possibility of a market reversal. They can also be an indication that it’s time to conclude holdings by taking profits or decreasing losses.

What Is The Moving Average Envelope And How Do I Calculate It?

The moving average envelope is calculated differently depending on the type of moving average utilized. Moving averages can be divided into two categories.

Moving averages, both basic and exponential. An exponential moving average, as opposed to a standard moving average, delivers more current data.

As a result, it reacts faster than the simple moving average. However, because of the great sensitivity, you will be exposed to fake-outs.

Set the required time period value regardless of the moving average being used. After that, the envelopes’ percentage value is set.

A 20-period moving average with a 2% envelope, for example, would be plotted as follows:

This expansion is plotted on the upper envelope:

SMA + 20-day SMA (20-day SMA x .02).

The lower envelope, on the other hand, is determined in a similar manner with a little difference:

SMA of 20 days – (20-day SMA x .02).

How To Use The Moving Average Envelope Indicator In Trading

The moving average envelope is traded in the same way that a traditional moving average is. The only distinction is that the envelope is employed to validate the trend after the cross.

Taking signals based on overbought and oversold conditions is a less typical technique to trade with this instrument.

Confirming Trends With The Envelope

A moving average is used to bridge the gap between the two envelopes once more. As a result, it is a trend-following indicator.

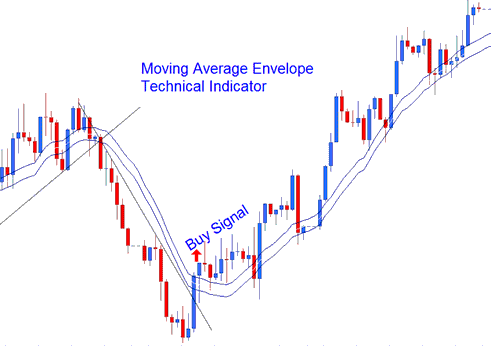

When the price closes above the top band, it is considered a buy signal. When the price closes below the lower band, on the other hand, it is a sell signal.

The price closed below the moving average in the graphic above, giving a sell signal. A closure beneath the bottom envelope is required for further confluence.

Overbought and Oversold Conditions Can Be Deduced Using The Envelope

The top and lower envelopes could serve as dynamic levels of support and resistance. The same rules apply here as they do for standard support and resistance levels.

Because they are not static, they are considered dynamic. The pair is overbought when the price reaches the upper envelope and then reverses. This behavior typically indicates a sell signal.

The currency pair is oversold when the price rejects the lower band; buy signal.

When a trend is strong, though, it’s vital to remember that oversold and overbought circumstances can persist.

The price rejects the lower band, as seen above; the market is oversold. Oversold conditions indicate that a purchase reversal is likely to occur soon. As a result, a purchase order is placed here for that reason.

“Can you tell me what the moving average envelope says?”

The rising movement of the envelopes reflects the upward tendency. The market is in a downturn if the envelopes are falling.

In addition, a pair is overbought if the price does not break through the upper band. This behavior typically indicates a sell signal.

The currency pair is oversold when the price rejects the lower band; buy signal.

“Should I use a moving average?”

Moving averages may be simply adjusted to fit the demands of every trader. Trading styles and the time frame in question may necessitate such a change.

Moving averages with short durations are particularly sensitive to price movements in general. A moving average with a longer time span, on the other hand, is less sensitive to price movements.

As a result, it’s important to make sure a moving average’s period isn’t too short, or it’ll tend to follow price too closely.

What Is The Moving Average Envelope And How Do I Use It?

Many traders use simple or exponential moving averages as their primary indicator.

The moving average envelope enhances trading results significantly. False signals are reduced thanks to enhanced entry rules.

It confirms trends while also alerting traders to overbought and oversold positions. When you combine all of these factors, you’ll be one step closer to forex market consistency.