Using a take profit is one of the best ways for traders to minimize their losses while maximizing their profits.

Everyone understands that trading in the forex market entails a significant amount of risk.

Many traders employ a variety of market orders to reduce their risk and increase their profit.

There are two types of orders.

- The market order and the pending order are the two types of orders.

- Stop-loss orders, take-profit orders, limit orders, and so on are examples of these orders.

What Is A Take Profit And How Does It Work?

It is a profit-claiming order used by traders.

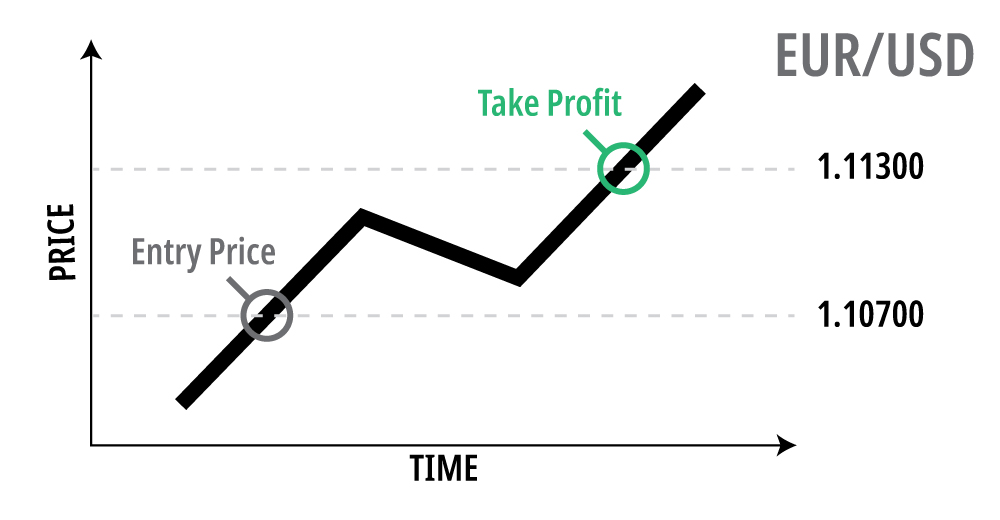

Traders use this order to designate the price at which they want to close a profitable trade.

A broker automatically closes a deal when the price reaches the predetermined price, and the profit is credited to the trading balance.

The stop-loss order is used to end a deal after the market price reaches a certain level in order to minimize a loss.

Many traders refer to a T/P as a tool for claiming a profit whenever the market price hits a certain level.

The T/P order is one of the risk management strategies employed by FX traders.

This is the type of order that many traders employ when they need to do multiple things at once.

They can continue about their everyday routines as the market price moves after they place this order.

What Is A Take Profit Order And How Do I Use It?

A trader must thoroughly analyze the market before placing a trade.

This is why technical analysis is so crucial in the currency market.

He is anticipated to place his trade after completing his analysis.

He must employ certain forex orders when placing his transaction in order to reduce the danger of losing it.

A T/P order is one of the orders that many traders utilize in such situations.

Here are some examples of how to put the order to work for you.

Mr. Sam, a seasoned forex trader, is looking to take a long position on the EURUSD currency pair.

The market price was 1.50000 when he placed his trade, and he set a T/P of 50 pips. What does this mean?

This indicates that Mr. John is attempting to recoup his profit at the 50-pip mark.

1.50050 is the 50-pip level (Kindly check our article on pips calculation if you would love to know more about it).

His deal will automatically close whenever the market price reaches 1.50050.

The profit will then be added to his trading account by his broker.

Let’s look at another scenario.

Sam is a novice trader who took a short position on the GBP/USD currency pair. His take-profit was set at 100 pips.

Before he entered the deal, the market price was 1.25250. What exactly does this imply?

This means that when the market reaches the 100-pip level, his transaction will automatically close.

The profit will then be added to his trading account by his broker.

Because this is a sell order, keep in mind that the 100 pips point is at 1.25150.

However, do not assume that if a trade goes against a trader’s analysis, he would lose the same amount of pips as his take profit.

Most Commonly Asked Questions (FAQs).

What Is a Take Profit and How Does It Work?

It is an instruction given to a broker to close a trade whenever the market price reaches a certain level.

What is the T/P and how does it work?

The broker closes such a trade once the market price hits the set T/P price.

The profit is then added to the trader’s trading balance by the broker.

What is Take Profit in Summary?

A take-profit order instructs a broker to close a trade whenever the price reaches a certain level.

The profit is added to the trader’s trading balance after the broker closes the trade.

One of the orders used by traders to increase their chances of profit is the T/P order.

One of the risk management methods is to use a T/P order.

Using a stop-loss and a T/L combined, however, is the best approach to reduce the chance of losing a trade.

It is feasible for traders to make a profit up to a certain point before losing a deal.

During retracements or reversals, this happens.

The best approach to avoid this situation is to claim a profit before the loss begins.

As a result, many forex traders advise newcomers to avoid being greedy when trading.

Was this article beneficial to you?

Please leave a remark and tell your friends about it.