The EBITDA (earnings before interest, taxes, depreciation, and amortization) formula is one of the most important indicators of a company’s financial success and is used to calculate a company’s earning potential. When evaluating profitability with EBITDA, elements like debt financing and depreciation and amortization (D&A) charges are removed.

TAKEAWAYS IMPORTANT

- EBITDA can be calculated in two ways: first, using operational income as a starting point, and second, using net income as a beginning point.

- Depending on what is included in operating income, the two metrics may generate different outcomes.

- Because it eliminates the effects of financing and accounting decisions, EBITDA may be used to examine and compare profitability across organizations and industries.

- Depreciation, on the other hand, is not included in EBITDA (it is brought back for calculation reasons) and might cause distortions for organizations with a lot of fixed assets.

- It’s worth noting that the EBITDA calculation isn’t regulated, so corporations may be able to manipulate data to make their business appear more successful.

There are two EBITDA formulas.

The first EBITDA formula takes operational income as the starting point, while the second formula starts with net income.

12

With the rise of leveraged buyouts in the 1980s, EBITDA became a popular statistic among analysts. Companies in distress were not lucrative, making them difficult to examine. EBITDA was designed to help determine if these companies will be able to repay the interest on the debt used to fund the transactions. Analysts have continued to utilize EBITDA to gauge how a company is really performing since then.

Using Operating Profits

Both formulas have advantages and disadvantages. The first formula can be seen below.

Operating Income + Depreciation & Amortization = EBITDA

Operating income is a company’s profit after operating expenses, or the costs of doing business on a daily basis, have been deducted. By removing interest and taxes, operating income allows investors to separate the earnings for the company’s operating performance. As the name implies, operating income shows how much money a company produces from its activities.

Sales less operational expenses, such as labor and cost of goods sold, is a common formula for calculating operating income (COGS). Because operating income has already been calculated before interest and taxes, EBITDA requires only the addition of D&A.

On the income statement, depreciation and amortization are sometimes grouped together as operational expenses. As a result, the D&A figure is frequently included in the cash flow statement under cash flows from operating operations.

Making Use of Net Income

The following is the second formula for determining EBITDA:

EBITDA = Net Income + Taxes + Interest Expense + Depreciation & Amortization + Depreciation & Amortization + Depreciation & Amortization + Depreciation & Amortization

Unlike the first formula, which starts with net income and adds back taxes and interest expense to arrive at operating income, the second formula starts with net income and adds back taxes and interest expense to arrive at operating income. Net income, tax expense, and interest expense can all be found on the income statement, much like operating income from the formula above.

Because net income contains line items that aren’t included in operating income, such as non-operating income or one-time expenses, the two EBITDA computations can have different results (e.g. restructuring charges).

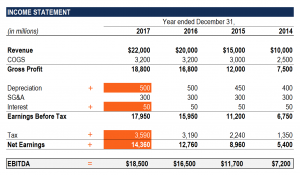

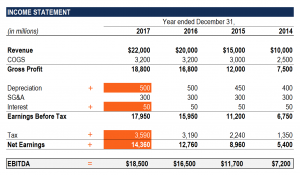

Examples of EBITDA

The income statement for Walmart (WMT) as of January 31, 2021 is shown below.

It’s worth noting that depreciation is frequently taken from the cash flow statement, as shown here:

Using operating income, below is Walmart’s EBITDA:

Using Operating Income to Calculate EBITDA at Walmart

| Operating Income | $22.55 billion |

| + Depreciation & Amortization | $11.15 billion |

| = EBITDA | $33.70 billion |

EBITDA can alternatively be calculated by subtracting interest, taxes, depreciation, and amortization from net income. Walmart’s EBITDA, calculated using the net income calculation from the fiscal 2021 data, is:

Using Net Income to Calculate EBITDA at Walmart

| Net Income | $13.71 billion |

| + Depreciation & Amortization | $11.15 billion |

| + Net Interest Expense | $2.19 billion |

| + Income Taxes | $6.86 billion |

| = EBITDA | $33.91 billion |

It’s worth noting that the EBITDA formulas can occasionally produce different results depending on whether the computation is based on net income or operating income. The difference in Walmart’s EBITDA number is $210 million in other gains. Because this $210 million is shown in net income but not operating income, the EBITDA calculation based on net income is higher.

Putting Everything Together

Because it eliminates the effects of financing and accounting decisions, EBITDA may be used to examine and compare profitability across organizations and industries. Because EBITDA has inherent limits, investors and analysts may want to employ various profit indicators when examining a company’s financial performance.

As previously noted, depreciation is not included in EBITDA (it is added back for calculation reasons) and might cause distortions for organizations with a large number of fixed assets. Companies that have a lot of fixed assets and a lot of depreciation expense appear to have a greater EBITDA than companies that have almost no fixed assets (all else being equal).

Oil firms, for example, have a lot of fixed assets, such as property, plant, and equipment. As a result, the depreciation expense would be significant, and the company’s earnings would be inflated using EBITDA if depreciation expenses were excluded.

Adding back D&A as well as taxes and interest can actually make some businesses profitable (that would otherwise be unprofitable). In the 2000s, EBITDA estimates were utilized by tech corporations to make many dotcom businesses appear profitable when they were not.

EBITDA Formula Frequently Asked Questions

What Is EBITDA and How Do You Calculate It?

The first method of calculating EBITDA is to add operating income and depreciation & amortization together. The second is derived by multiplying net income by taxes, interest expense, and depreciation and amortization.

What Is the Importance of EBITDA?

Analysts and investors use EBITDA to analyze company performance by excluding the effects of financing and accounting decisions. It is capital structure agnostic, meaning it will not reward (or punish) a company based on how it funds its operations (i.e. equity vs. debt).

What Is a Reasonable EBITDA?

Like most financial measurements, a “good” EBITDA is dependent on the firm and industry. EBITDA alone does not reflect a company’s profitability until it is compared across time periods for the same company. When comparing companies, EBITDA margin or an EBITDA valuation metric (such as EV/EBITDA) is far more useful. However, a “good” EBITDA margin or valuation number will be determined by the company’s industry and how it compares to its peers.

In business, what does EBITDA stand for?

Earnings before interest, taxes, depreciation, and amortization (EBITDA) is the acronym for earnings before interest, taxes, depreciation, and amortization. It’s a prominent profitability metric that allows businesses to compare apples to apples. It calculates a company’s profitability by subtracting its capital structure, taxes, and non-cash depreciation and amortization expenses from its generating capacity.

Final Thoughts

Because the EBITDA calculation is not regulated, corporations can manipulate the figure to make their business appear more profitable. If the second formula made the company appear more profitable, an unscrupulous company may use one calculation method one year and switch the calculation method the next year.

EBITDA may be a very useful indicator for comparing past performance if the computation process is consistent from year to year. Meanwhile, whether assessing margins or determining valuation, EBITDA is a popular technique for examining companies in the same industry. The enterprise multiple (EV/EBITDA) is a prominent valuation indicator that analyzes EBITDA to determine whether a company is overvalued or undervalued.