Forex Direct

March 24, 2022 2023-01-14 12:09Forex Direct

Forex Direct

You can trade on the physical market without the use of a middleman with forex direct market access (DMA). Get a leg up on the competition with Forex Direct, our DMA service that gives you better pricing, more liquidity, faster execution, and more control over your trades. Learn more about Forex Direct with IG, including the advantages of forex DMA and the associated fees.

Are you ready to start forex trading?

LEARN ABOUT FOREX DIRECT

What is direct market access and how does it work?

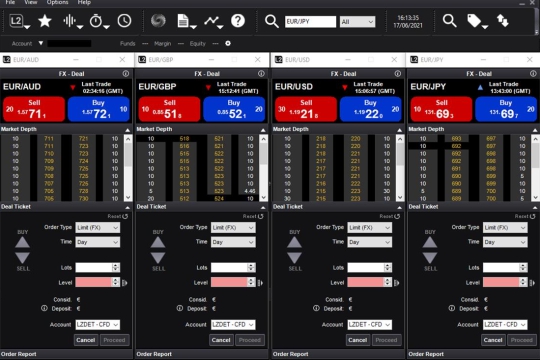

Direct market access (DMA) is a kind of FX execution that gives traders direct access to the real market. FX trading is traditionally done through a forex broker, who will obtain quotes from exchanges and market makers and then present their client with the best price. However, DMA is an electronic trading system that allows you to see the various orders and prices for yourself before placing your trade.

It's vital to remember that while you're trading based on underlying market prices and depth, you're actually getting a CFD from us when you place a transaction. This is how the Forex DMA works:

Advantages

- DMA shows the best bid and offer prices for a certain market, as well as additional prices on either side of the order book.

- When you place an order, your margin is immediately verified to make sure you have enough money to cover the margin on your planned trade.

- Your order is then placed in the market and a parallel CFD is built between you and the broker if the margin check is successful.

Forex Direct platforms

Trading apps

L2 – our free DMA platform

Terminals and APIs

Advantages of direct market access in forex

Direct market access has a number of advantages, including the ability to set your own pricing and interact directly with other market participants. DMA also has the following advantages:

Drawbacks of direct market access in forex

Because of the complex trading environment of forex DMA, there is the potential for greater risk and a few major drawbacks that you should be aware of before you begin trading:

Frequently Asked Questions

What do I need to start trading forex with direct market access?

To begin trading forex with DMA, you must first locate and open an account with a competent forex DMA provider. To reduce currency risk, it’s also critical to develop a suitable forex trading strategy and implement a risk management approach.

How can I trade forex with direct market access?

DMA shows the best bid and offer prices for a given forex pair, as well as additional prices on either side of the order book. After that, you would choose your preferred price and submit an order. We place an order in the forex market and, at the same time, build a parallel forex CFD between you and us once we’ve confirmed you have adequate cash to cover the margin.

It’s important to remember that when you trade CFDs, you’re not buying the currency outright.

What is the difference between sponsored access trading and direct market access?

DMA allows you to use our technology while also gaining access to a variety of IG perks. Sponsored access trading, unlike DMA, makes use of the technology but does not go through the broker or provider’s management systems; instead, the order is confirmed by the exchange. This means that your supplier will not provide any pre-trade risk management or other advice.