We must first determine whether news items are even worth trading before building a “Trade the News” method.

“Which news releases should I trade?” is a question you want to be able to answer.

The big event risks that have a significant influence on the major currencies should be familiarized by forex traders.

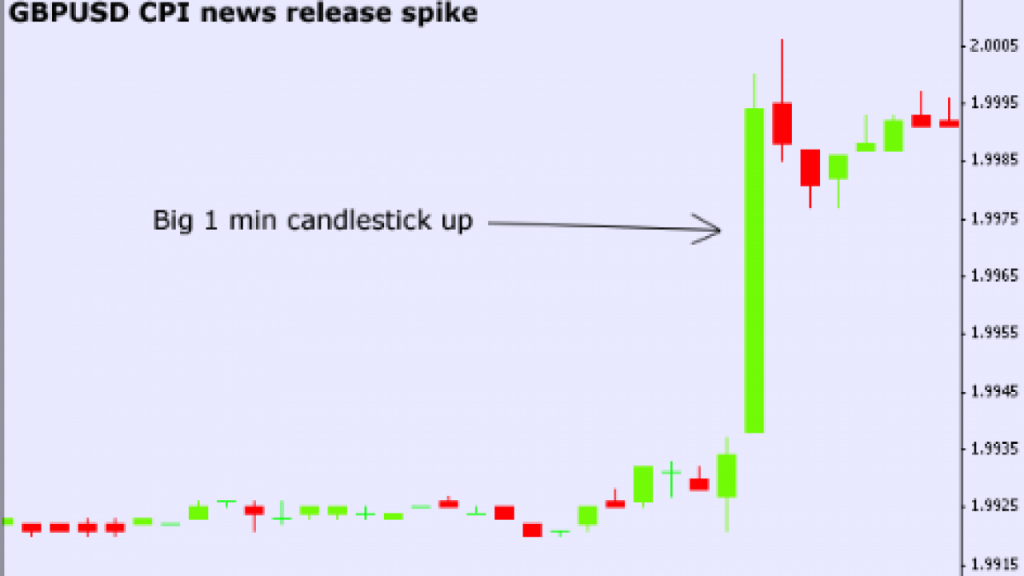

Remember, we’re trading the news because it has the potential to increase volatility in the short term, so we’d prefer to trade only the news that has the most market-moving potential for the currency market.

The news that tends to influence market action and create volatility generally consists of the following:

- Modifications in central bank policy (sometimes known as “monetary policy”).

- Changes in government policy (sometimes known as “fiscal policy”)

- Economic data releases have had unexpected results.

- Random tweets from a certain world leader who enjoys emblazoning his name on skyscrapers.

Knowing about forthcoming significant event risks might help you stay on the right side of the market.

How to Find Volatility-Producing Events

The Beo Forex Economic Calendar highlights the most important events and economic data from the countries with the most widely traded currencies.

On any given week, there might be over a hundred activities planned! It might be a pain in the buttocks to filter through so many occurrences.

Fortunately, our Economic Calendar makes determining the relative importance of any individual event simple.

You may use our Economic Calendar’s “Impact” filter to narrow down event listings.

By choosing just “HIGH,” for example, the Economic Calendar will only show events that have historically been associated with market volatility.

If you spend some time looking over the Economic Calendar, you’ll see that the most important events tend to revolve around interest rate adjustments, inflation, and economic growth, such as retail sales, manufacturing, and consumer sentiment.

Some instances are as follows:

- Central banks make interest rate choices.

- Inflation is a term that is used to describe the (CPI, PCE, PPI)

- Data about the labor market (unemployment, wage growth)

- Growth of the economy (GDP)

- Sales in the retail sector

- Production in the industry

- Surveys of business sentiment

- Surveys of the manufacturing industry

- Surveys of consumer confidence

- Data about the housing market (sales, construction)

- Balance of trade

Different nations may call comparable statistics by different names, but we attempt to make that clear in the Economic Calendar.

The relative relevance of this event may alter depending on what’s going on in the globe right now.

For example, interest rate decisions may be the major emphasis at one moment, but at another time, it may appear that no one cares.

This is why it’s critical to keep educated and understand what the market is now focused on.

Pay close attention to news from the United States.

While most economic news from other nations affects the markets, the largest movers and most closely watched news comes from the United States.

Whether it’s in the realms of military affairs, geopolitics, industry, energy, science, culture, or technology, the United States remains the world’s most powerful country.

It’s even been referred to as a “financial powerhouse.”

Even though setbacks, imbalances, and vulnerabilities have weakened its position, the US dollar’s dominance and influence will not be duplicated anytime soon.

The United States continues to have the world’s largest economy, and the dollar remains the world’s reserve currency.

This implies that the US dollar is involved in around 90% of all currency transactions, making US news and statistics crucial to follow.

With that in mind, let’s look at some of the most tumultuous news in the United States.

You should also pay attention to geopolitical news, such as inflation reports and central bank speeches, in addition to inflation reports and central bank speeches.

- Pandemics

- Wars

- Natural calamities

- Protests and political upheaval

- Elections are coming up soon.

Even if they don’t have the same impact as the other stories, they’re still worth paying attention to.

When our resident economic nerd, Wilson Walter, is in a good mood, he’ll generally write an essay on impending news stories that you can play with, complete with trading methods!

Keep an eye on the stock market as well. Especially the stock market in the United States.

There are times when equity market sentiment is a leading indicator of major currency market movements.

Our next step is to evaluate which currency pairings are worth trading now that we know which news events cause the biggest movement.

How to Pick Currency Pairs for News Trading

You now wish to trade the currency linked with the event’s economy once you’ve identified the event to watch.

When it comes to “Trading the News,” picking the right currency combination is crucial.

As a news trader, you’re attempting to accomplish two goals:

- Profit from the short-term increase in volatility…

- While lowering your transaction expenses to a bare minimum

Because news might produce higher volatility (and hence more trading opportunities) in the forex market, it is critical that we trade profoundly liquid currencies.

The narrowest spreads are seen in currencies with high liquidity, which helps you to keep your transaction costs low.

We can be confident that our orders will be executed smoothly and without “hiccups” when we trade with liquid currency pairings.

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CHF

- USD/CAD

- AUD/USD

Have you noticed anything interesting here?

That’s correct! All of them are significant currency pairings!

Remember that significant pairings have the narrowest spreads since they have the most liquidity.

Because spreads grow when news items are released, it makes logical to start with the pairings with the narrowest spreads.

Let’s look at some strategies for trading the news now that we know which news events and currency pairings to trade.